Like the 3,200 other pages of evidence uncovered and descriptions of crimes on this site, this web page is only one part of a massive multi-state entanglement of government corruption and cover-up. See size

Evidence was uncovered in parts over years, and not in the same order as the crimes occurred or the evidence was created. Statements were made based on what was known at the time.

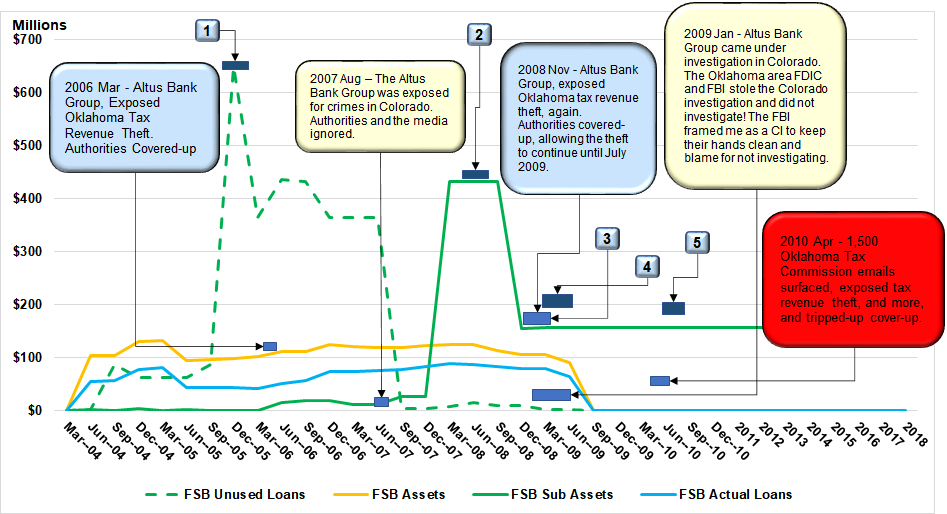

Dates are approximate because government filings and reports vary in some cases up to months if not This is part of cover up. One example is Oklahoma's Openbooks, which started out late with only a fraction of what was required to be added each year. Plus, the data was littered with data entry and spelling errors, meaning you have to go through one entry at a time. This amount to more than 17,000 entries in 2017.

| Click on a chart to expand. | |

|

Multi-state Entanglement Of Mistakes Crony Corruption Couldn't Shake.

|

Cover-up and three Mutually Contradicting Versions of Crimes and Victims

|

| More timelines. View | For more connection and entanglement diagrams. View |

| Abbreviated timeline. | ||

| Circa Date | Subject | Link |

| 03/01/2006 | The Altus OK Bank Group, First Bank Altus OK (FSB Altus), and subsidiaries (3), mainly Altus Venture, were setting up a 4,000-acre resort area land development partnership scam (4) in Colorado. Mountain Adventure Investment Properties (MAPI) | View |

| 03/30/2006 | Mistake exposed. The Tulsa World exposed Altus Venture in what was then billed as a "tax credit abuse controversy," and lawmakers would later covered-up with SB1577. In short, Altus Venture's claim to invest $221 million in Quartz Mountain Aerospace (QMA) (5) was two of 173 fraudulent 2006 investment claims for five of Oklahoma's 63 different tax credit programs. The five tax credit programs were structured for shared investment funds. | See articles |

| 03/30/2006 | Another mistake that created more evidence. Chaparral Energy (3) (9) caught off guard revealed, via SEC filings, it had bought $30 million tax credits, at half price, from Altus Venture. 2009 the Oklahoma Tax Commission allowing multiple uses of the same tax credits, issued Chaparral and Altus Venture $90 million in gross production tax refunds for the $60 million in counterfeit tax credits. Add the $15 million Chaparral paid for its $30 million tax credits comes at least $105 million. | View |

| 2006 - 2009 | Size for one part. Five hundred investment claims totaling $2.5 billion with $625 million tax credits by 25 funds claiming 125 investors (10). The five tax credit types (19) that were structured for shared investment funds. | View |

| 08/07/2007 | FSB Altus and Altus Venture exposed for crimes in Colorado (4). Evidence includes proof of Altus Venture's fraudulent 2006 Oklahoma tax credit investment claims. | View |

| 12/31/2007 | The wheels started coming off. QMA was broke, and the Altus Bank Group started the first of five new scams to keep open longer | View |

| 10/01/2008 | Colorado victims found the website Prowlingowl.com, contacted me, and sent their evidence to add to the website. | View |

| Jul to Nov 2008 | Unexpected events. The most drastic drop in oil price history, 70%, occurred from July to November 2008 (6.1). | View |

| 11/08/2008 | Tax revenue theft, exposed and covered-up again to allow theft to continue. QMA (Altus Bank Group) prematurely failed for lack of funding. Another reason state law required the Oklahoma Tax Commission to recover the counterfeit 2006 tax credits. Instead, the Oklahoma Tax Commission swapped the counterfeit tax credits (3), some previously used (17) for gross production tax revenue off-the-books (21). There were other problems, including the most drastic drop in oil price history (21), the pending rash of bank failure, and Madoff's self-exposure that led to the SEC's public roasting (22). | View |

| Nov 2008 - July 2009 | Gross Production Tax Revenue Theft and Problematic Payoff! | View |

| 01/16/2009 | Altus Bank Group came under investigation for crimes in Colorado. Oklahoma area bank regulators and the FBI stole the Colorado investigation, did not investigate, and the FBI framed me as a Confidential Informant (11)! The FBI tried to use me as a Colorado dummy pigeon agent to avoid exposure to Colorado victims, witnesses, and evidence. | View |

| 02/28/2009 | Regulators warn First State Bank of Altus. | View |

| 06/30/2009 | Oklahoma was $1.2 billion in the hole at the end of FY 2009. Total revenue for the 1st Qtr. FY 2010 was only $1.3 billion. | View |

| 07/31/2009 | The Altus bank was closed to cover-up (6). supposedly because the bank was $8 million off-balance. $91 million assets and $99 million liabilities. Bank regulators failed to account for $216 million in subsidiaries' accounts. The $156 million showing in the bank holding company's Federal Reserve subsidiaries report, and $60 million gross production tax refunds paid Altus Venture during the bank examination, Jan - Jul 2009. | View |

| 08/1/2009 | More cover-up. More cover-up. Oklahoma state authorities trying to cover-up the stolen revenue, starting August 2009, diverted (stole) $2.12 billion from 2009 Federal Stimulus Funds (earmarked for education and children's health care) and drained Oklahoma's, Rainy-Day Fund. $2 billion was all the money state authorities could get their hands on, but not enough to keep Oklahoma out of a recessionary tailspin. Diagramed. | View |

| 09/15/2009 | A state representative obtained the names, amounts, and dates for $643 million in 2006 fraudulent bank loans. | View |

| 10/15/2009 | A state representative launched a series of Open Letter Requests to the Oklahoma Tax Commission. This led to OTC auditors discovering no documentation existed for tax credits and later obtaining more than 1,500 Confidential Oklahoma Tax Commission (OTC) emails and confidential tax letter rulings | (9) |

| 04/28/2010 | 1,500 OTC emails and confidential tax letter rulings (Nov 2008 - Apr 2010) were uncovered by a state representative, and exposed tax revenue theft, and more. Among other things, the emails revealed tax credits were not documented, and no records were maintained for tax credit used. | View |

| 4/28/2010 | ||

| 05/01/2010 | Letters of testimony from a former president of QMA attesting to the scam. Ignored. This president, John Daniel was in charge of QMA during the period Altus Venture's claimed to have invested $221 million in QMA | View |

| 05/23/2010 | Avondale (Oak Hills), $2 for $1 retroactive tax credits offer exposed. Moratorium allowed time to snatch up unlimited retroactive (2009) tax credits. | View |

| 05/23/2010 | Evidence reported to various authorities and media led to more FBI threats to silence. | View |

| 06/22/2010 | View | |

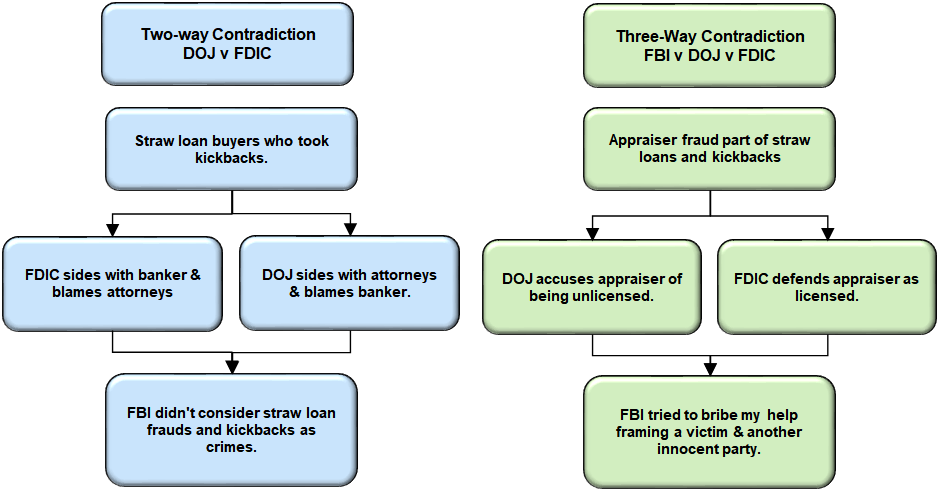

| 06/24/2010 | FBI's failed bribe attempt to frame innocent parties, in Colorado, for appraiser fraud. This was one of three mutually contradicting versions of appraiser fraud (13). More below. | View |

| Aug 2010 | The Oklahoman reported in a series of articles how the Russian connection funded Kevin Calvey's U.S. Congressional election campaign, and possibly 31 other unidentified parties, starting early 2008. FBI dismissed me as a Confidential Informant. | View |

| 03/15/2011 | FBI emails March 15 & 16. Verified FBI confidential informant entrapment. | Download |

| 5/7/2012 | Federal civil trial FDIC v Andrews Davis Law Firm and Attorneys Matthew Griffith and Joe Rockett. Case 5:11-cv-00686?M | View |

| 5/7/2012 | View | |

| 3/18/2014 | Federal civil trial FDIC v Edsin LLC and Matthew Griffith Andrews Davis Law Firm Attorney. Case 5:13 cv 00006 | View |

| 4/15/2015 | Doughty and Anderson indicted. | View |

| 04/13/2016 | My efforts to contact FDIC OIG Agent re FBI & FDIC cover-up before June 2016 trial. Ignored. | Download |

| 06/01/2016 | DOJ's Trial Cover-up | View |

| 7/1/2016 | Doughty convicted by an abused federal jury on 10 counts of bank fraud conspiracy in spite of the DOJ's bungled (20) attempts to undermine its own case. | View |

| 2010 - 2017 | Two-way and three-way contradictions - FBI v DOJ v FDIC - court cases. Diagram. | View |

| 08/15/2017 | FBI again tries diversionary cover-up of its roles by announcing "Blind eye campaign." | View |

| 06/10/2015 | Weak Internet Security Leaves FEC Vulnerable to Hackers | View |

| 01/16/2019 | Out of Commission: How the Oklahoma Department of Securities Leaked Millions of Files | View |

| 04/14/2019 | FBI data breaches U.S. (13). | View |

| Move on to fill in some gaps with more timelines. View | View or other timelines View | |