Like the 3,200 other pages of evidence uncovered and descriptions of crimes on this site, this web page is only one part of a massive multi-state entanglement of government corruption and cover-up. See size

Evidence was uncovered in parts over years, and not in the same order as the crimes occurred or the evidence was created. Statements were made based on what was known at the time.

Dates are approximate because government filings and reports vary in some cases up to months if not This is part of cover up. One example is Oklahoma's Openbooks, which started out late with only a fraction of what was required to be added each year. Plus, the data was littered with data entry and spelling errors, meaning you have to go through one entry at a time. This amount to more than 17,000 entries in 2017.

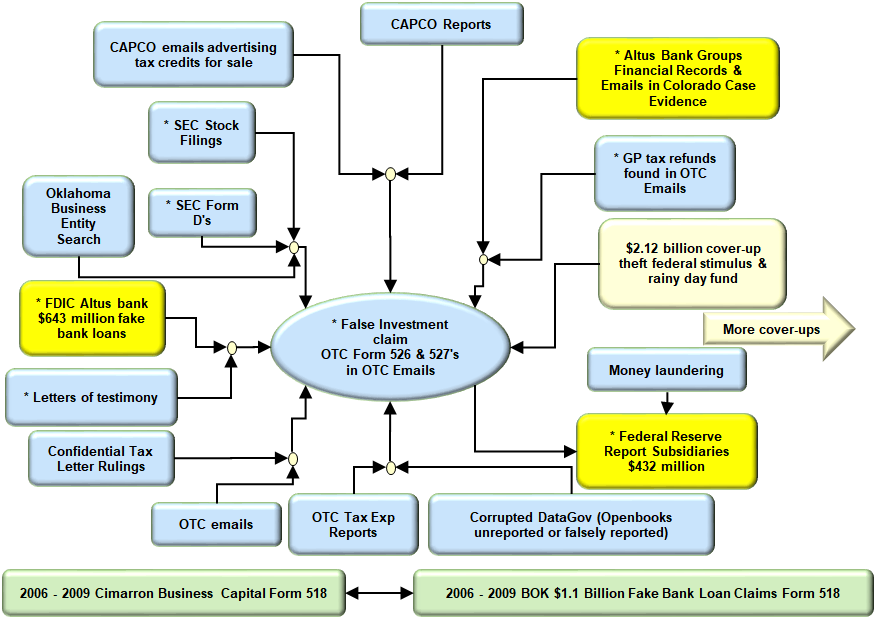

Multiple forms of evidence exposing multiple acts and forms of corruption.

This evidence applies to First State Bank Altus OK subsidiaries and affiliates Altus Bank Group. The Altus bank group was only one of many involved, but they made an inordinate number of mistakes and left an astounding amount of evidence. The Altus bank group was only one of many, but they made an inordinate number of mistakes and left an astounding amount of evidence.

Forms of evidence uncovered in Oklahoma crimes. Below is a list of evidence uncovered, and parts apply in different mixes in different cases. In the Altus bank's multiple crimes, all of the below apply. The point is to demonstrate the extent of back turning.

|

Color codes: Five (of Oklahoma's 63) Tax Credits Structured for shared investment funds (CAPCOs). Yellow and Blue: Capital Formation Incentive Act (CFIA) Tax Credits 68 2357.62, .63, .73, .74 Green: Venture Capital Tax Credits 68 2357.7: Bank of Oklahoma and Cimarron Business Capital Yellow: Tax credits used by Altus bank group. |

False Investment claims

- * OTC Form 526 & 527's found in 1,500 OTC Emails

- CAPCO emails advertising tax credits for sale

- * False Investment claim OTC Form 518's in OTC Emails

General

- Oklahoma Business Entity Search View

- Blocked Bank Investigations - Re: FDIC Agent

- * Federal bank reports

- * FDIC Altus bank $643 million fake bank loans. View Html

- * FSB FDIC Dec 2005 Call Report Asst Liab unused loans Pg 9 20. View PDF

- * Six Fake Loan Users. Bank subsubsidiaries that are shell LLCs with no assets. View Text File

- * Federal Reserve Report Subsidiaries $432 million

Evidence found in SEC form D's and Stock filings proving tax credit investment claims were false, and multiple uses of the same tax credit.

- * SEC Form D's

- SEC Download Notes View Text File

- SEC Filings View Text File

- SEC Stock Filings and Form Ds View

Part of false reporting evidence

- 2005-2006 Tax Expenditure Report View PDF File

- OTC Tax Exp Reports

Part reports filed

- Report to Oklahoma Attorney General re: BOKF, Cimarron, MAPI, CFIA 07/18/2010 View DOCX File

Crimes using Oklahoma State Tax credits and tax refunds

- 2006 - 2009 BOK $1.1 Billion Fake Bank Loan Claims Form 518

- 2006 - 2009 Cimarron Business Capital Form 518

- Cimarron's 2006 Investments 12/31/2008 View PDF File

Oklahomas Five Shared Investment funds included

Capital Formation Incentive Act (CFIA) (2006) tax credits, 4 types View Xlsx file - Sheet CFIA Capcos

- 68 2357.62 Tax Credit for Qualified Investment in Qualified Small Business Capital Companies - Pass-Through Entities

- 68 2357.63 Tax Credit for Qualified Investments in Oklahoma Small Business Ventures - Pass-Through Entities Investors

- 68 2357.73 Tax Credit for Qualified Investment in Qualified Rural Small Business Capital Companies - Pass-Through Entities

- 68 2357.74 Tax Credit for Qualified Investment in Oklahoma Rural Small Business Ventures - Pass-Through Entities

Venture Capital Tax Credits View Xlsx file - Sheet VC Investors

- 68 2357.7 Credit Against Tax for Investments in Qualified Venture Capital Companies - Pass-Through Entities

Misc Confidential OTC emails

- Confidential Tax Letter Rulings. Describes crimes. View Text File

Letters of testimony. Statements by former President of Quartz Mountain Aerospace on false tax credit investment claims. Sent to 1) the Oklahoma State House Subcommittee prior to meeting with Tony Mastin the head of the Oklahoma Tax Commission (OTC), and 2) Altus Times. The house tax committee ignored, but the Altus Times published.

- 20100404 1234 Re Letter to the editor. View

- 20100502 1621 Statement by former President of Quartz Mountain Aerospace on false tax credit claims. View

Multiple forms of evidence for the same crimes

- * Altus Bank Groups Financial Records & Emails in Colorado Case Evidence.

- * Letters of testimony

- * GP tax refunds found in OTC Emails

- Money laundering

Cover up

- Bank and Oklahoma Tax Commission Auditors prevented and ignored

- Corrupted DataGov (Openbooks unreported or falsely reported)

- More cover-ups

- $2.12 billion cover-up theft federal stimulus & rainy day fund

- CAPCO Reports

There are several public areas around Arbuckle just outside Ardmore that we can go and talk. I have never seen more than 1 or 2 others at one. I go this way to see my sister and family in Dennison. I would take my dog with me and stop at one area to let my dog run around a little.