Like the 3,200 other pages of evidence uncovered and descriptions of crimes on this site, this web page is only one part of a massive multi-state entanglement of government corruption and cover-up. See size

Evidence was uncovered in parts over years, and not in the same order as the crimes occurred or the evidence was created. Statements were made based on what was known at the time.

Dates are approximate because government filings and reports vary in some cases up to months if not This is part of cover up. One example is Oklahoma's Openbooks, which started out late with only a fraction of what was required to be added each year. Plus, the data was littered with data entry and spelling errors, meaning you have to go through one entry at a time. This amount to more than 17,000 entries in 2017.

For a list of more timelines.View

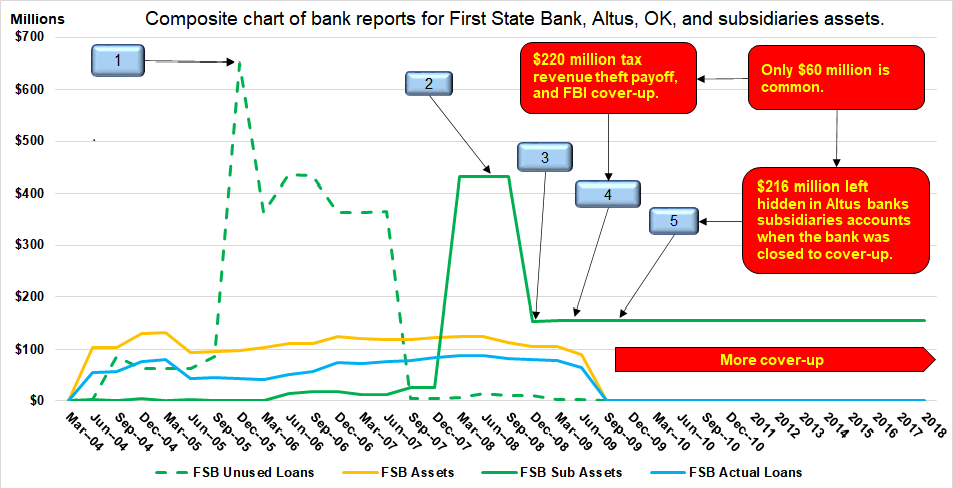

Below is the base timeline for other timelines, and is based on a composite chart of bank reports for First State Bank, Altus, OK, and subsidiaries assets. More on the Altus bank's subsidiaries, including bank mirroring accounts used to embezzle and launder criminal profits. View

Consider in light of the following and evidence uncovered.

- Compare the size of the bank's assets and bank regulators' charters/purposes. The bank was closed by the Oklahoma State Banking Dept., July 31, 2009, for $8 million off-balance. $99 million liabilities and $91 million assets. These discrepancies were roughly the amounts of bank assets when Doughty created $643 million fake loans in Dec 2005, and authorities covered-up in 2006, when the bank had only $26 million in subsidiaries assets.

- These are non-banking bank subsidiaries and are not FDIC backed. The FDIC did not seize the subsidiaries' assets ($156 million) when the bank was closed on July 31, 2009. Note the subsidiaries' assets were $432 million at one point. Considering the bank and banker's history, the $156 million and $432 million is one of the money laundering red flags. History includes using mirroring account to steal from victims in Colorado and the $25 million cashier's check Doughty created for Anderson to take to Dubai, UAE, and offshore banking center.

Most notable.

- $643 million in fraudulent loans (1). Altus Banks FDIC Reports. View.

- $432 million & $156 million (2) (3). Altus Banks Federal Reserve Reports. View.

- $220 million (4). Tax revenue theft pay-off $60 million for Altus Venture. However, Altus Venture was responsible for at least $96 million to $102 million and pocketed another $15 million from selling tax credits to Chaparral Energy (multiple uses of the same tax credits). View.

- $216 million (5) what was left in the Altus bank's subsidiaries accounts when the bank was closed to cover-up, July 31, 2009. $156 million (3) + $60 million Gross Production Tax Refund pay-off (4) during the bank regulators, supposed bank examination Jan - July 2009. View.

Note: 2018 was the last time I was contacted by someone in postion of authority that claimed an interest in the evidence uncovered.