Like the 3,200 other pages of evidence uncovered and descriptions of crimes on this site, this web page is only one part of a massive multi-state entanglement of government corruption and cover-up. See size

Evidence was uncovered in parts over years, and not in the same order as the crimes occurred or the evidence was created. Statements were made based on what was known at the time.

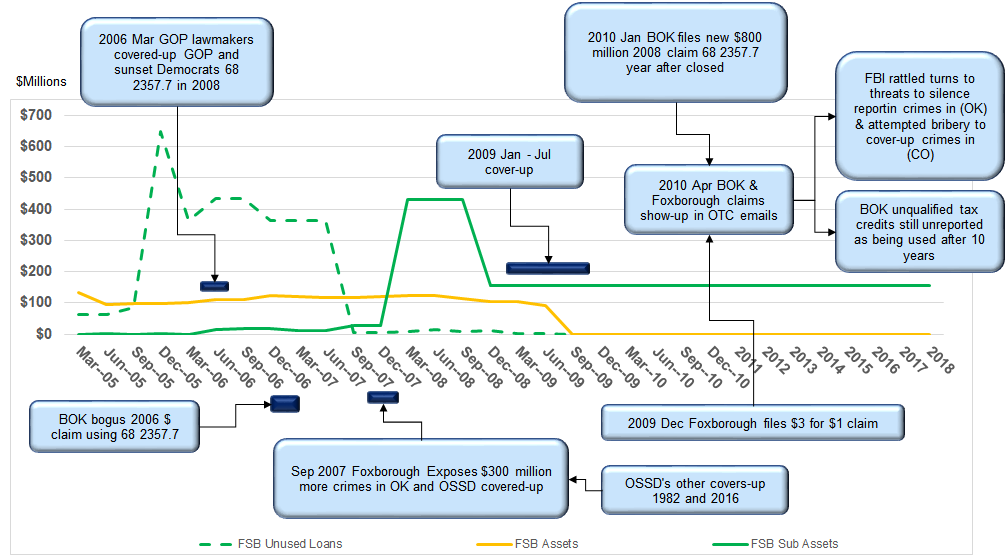

Dates are approximate because government filings and reports vary in some cases up to months if not This is part of cover up. One example is Oklahoma's Openbooks, which started out late with only a fraction of what was required to be added each year. Plus, the data was littered with data entry and spelling errors, meaning you have to go through one entry at a time. This amount to more than 17,000 entries in 2017.

Bank of Oklahoma and Foxborough are grouped together because their 2009 claims filed after cover-up were among the more obvious cases found in the 1,500 Confidential Oklahoma Tax Commission (OTC) emails. And both were questioned by OTC employees who were ignored. For that reason, I hand-carried to an FBI meeting on April 28, 2010, where I was threatened for trying to expose the agent to the evidence. Later, more 2009 claims were uncovered.

During the GOP lawmakers' 2006 cover-up (SB1577), they sunset Oklahoma's "Venture Capital" tax credit program 68 2357.7. 68 2357.7 was set-up by democrats in the 1980s with usage restricted to Bank of Oklahoma (George Kaiser) and Cimarron Business Capital Company owned by, Robert Heard. More on Robert Heard. View 2005 and 2006 was the first time the GOP had control of Oklahoma's statehouse for some 40 years. It was during 2005 they set-up using gross production tax refunds (HB 1608) to steal state revenue.

| Date | Subject | Link |

| 2006 - 2009 | Bank of Oklahoma, Cimarron Business Capital and OCIB. | View |

| 2006 - 2009 | Evidence for suspected Bank of Oklahoma and Cimarron Business tax credit frauds. | View |

| 2006 - 2009 | BOKF BOK Financial received tax credits for ineligible investments. | View |

| 03/30/2006 | Capital West Securities (formerly Stifel Nicolaus). | View |

| 09/04/2007 | Foxborough's Fictitious Name Scam, OKC 2009 City Garage Scam, and OSSD's 2007 Cover-up! | View |

| 09/22/2007 | Foxborough and Capital West Securities expose 2006 cover-up | View |

| 10/12/2007 | Oklahoma State Securities Dept covered-up crimes and mistakes by Foxborough and Capital West Securities. Covered-up with a miraculous three-week investigation of an unrelated issue. Common diversionary tactic. | View |

| 12/18/2007 | City funds used to pay construction contractor diverted through shell LLC's and claimed as a tax credit investment to obtain tax credits! | View |

| 12/04/2009 | WPG and Foxborough $51 million claim. Selling tax credits at $2 for $1, and taking $3 for $1 | View |

| 12/31/2009 | Dawn Cash was verifying Foxboroughs $3 for $1 for Mastin, who ignored. | View |

| 01/20/2010 | OTC email - BOK $800 million false claim, filed a year after the 2357.7 ended. BOK was allowed to use, and using was reverified shortly after Paul Doughty, and F. Don Anderson were indicted in 2015 | View |

| 03/15/2010 | Tax credit scheme used by Foxborough to scam tax credits. | View |

| 04/28/2010 | FBI starts threats to silence reporting, BOK and Foxborough claims we found in the OTC emails and filed after the 2009 cover-up. |