Like the 3,200 other pages of evidence uncovered and descriptions of crimes on this site, this web page is only one part of a massive multi-state entanglement of government corruption and cover-up. See size

Evidence was uncovered in parts over years, and not in the same order as the crimes occurred or the evidence was created. Statements were made based on what was known at the time.

Dates are approximate because government filings and reports vary in some cases up to months if not This is part of cover up. One example is Oklahoma's Openbooks, which started out late with only a fraction of what was required to be added each year. Plus, the data was littered with data entry and spelling errors, meaning you have to go through one entry at a time. This amount to more than 17,000 entries in 2017.

| A complete list of Oklahoma's falsely reported tax credits can be found at Oklahoma's Data.gov found here | View |

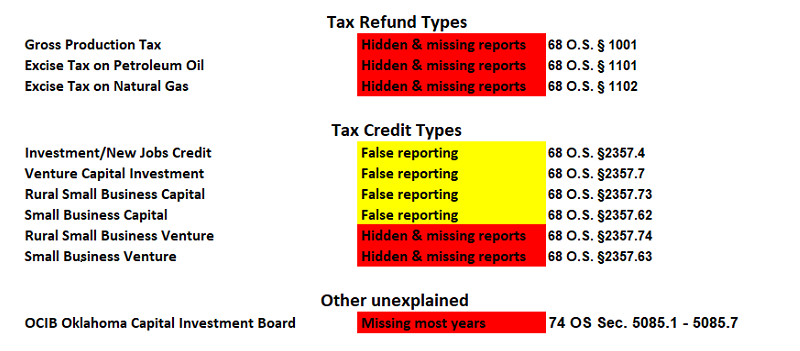

| Tax Credits (15 of 63 different types) and Tax Refunds (3 types) (13), Missing or Misreported After Cover-up | View |

| Internal OTC emails revealed OTC issues, including hidden tax refund checks for tax credits! | View |

| Reports Filed | View |

False Reporting Tax Credits & Refunds

What is missing?

Requirements are described in state Statute 68, Section 205. It might be helpful for those not familiar with the terms to (2) below. Here is the short version, and for the record and shake of brevity, the specifics of these comments primarily apply to the six largest money tax credits--two of which are not on Openbooks and four which have incorrect information substituted.

Section 2357.73 - Tax Credit for Qualified Investment in Qualified Rural Small Business Capital Companies - Pass-Through Entities Cite as: 68 O.S. § 2357.73 (OSCN 2011), Rural Venture Capital Formation Incentive Act

B. The credit provided for in subsection A of this section shall be thirty percent (30%) of the amount of a qualified investment in qualified rural small business Capital companies which is subsequently invested in an Oklahoma rural small business venture by the qualified rural small business Capital company and

may only be claimed for a taxable year during which the qualified rural small business Capital company makes the qualified investment in an Oklahoma rural small business venture if the funds are used in pursuit of a legitimate business purpose of the Oklahoma rural small business venture consistent with its organizational instrument, bylaws or other agreement responsible for the governance of the rural small business venture.

The qualified rural small business Capital company shall issue such reports as the Oklahoma Tax Commission may require attributing the source of funds of each qualified investment it makes in an Oklahoma rural small business venture. If the tax credit exceeds the amount of taxes due or if there are no state taxes due of the taxpayer, the amount of the claim not used as an offset against the taxes of a taxable year may be carried forward for a period not to exceed three (3) taxable years.

Qualified Rural Small Business Capital Companies or Capco is a pass-through entity, as is the investors, and every LLC in the chain.

G. If a pass-through entity is entitled to a credit under this section, the pass-through entity shall allocate such credit to one or more of the shareholders, partners or members of the pass-through entity; provided, the total of all credits allocated shall not exceed the amount of the credit to which the pass-through entity is entitled. The credit may only be claimed for funds borrowed by the pass-through entity to make a qualified investment if a shareholder, partner or member to whom the credit is allocated has an unlimited and continuing legal obligation to repay the borrowed funds but the allocation may not exceed such shareholder's, partner's or member's pro-rata equity share of the pass-through entity even if the taxpayer's legal obligation to repay the borrowed funds is in excess of such amount. For purposes of the Rural Venture Capital Formation Incentive Act, "pass-through entity" means a corporation that for the applicable tax years is treated as an S corporation under the Internal Revenue Code, general partnership, limited partnership, limited liability partnership, trust, or limited liability company that for the applicable tax year is not taxed as a corporation for federal income tax purposes.

Section 205 - Confidential Nature of Records and Files of Tax Commission

27. The disclosure of information, as prescribed by this paragraph, which is related to the proposed or actual usage of tax credits pursuant to Section 2357.7 of this title, the Small Business Capital Formation Incentive Act or the Rural Venture Capital Formation Incentive Act. Unless the context clearly requires otherwise, the terms used in this paragraph shall have the same meaning as defined by Section 2357.7, 2357.61 or 2357.72 of this title. The disclosure of information authorized by this paragraph shall include:

- the legal name of any qualified venture Capital company, qualified small business Capital company, or qualified rural small business Capital company,

- the identity or legal name of any person or entity that is a shareholder or partner of a qualified venture Capital company, qualified small business Capital company, or qualified rural small business Capital company,

- the identity or legal name of any Oklahoma business venture, Oklahoma small business venture, or Oklahoma rural small business venture in which a qualified investment has been made by a Capital company, or

- the amount of funds invested in a qualified venture Capital company, the amount of qualified investments in a qualified small business capital company or qualified rural small business Capital company and the amount of investments made by a qualified venture Capital company, qualified small business Capital company, or qualified rural small business Capital company;

- Non-appropriated spending.

- Tax refunds(1). Tax refunds including, refunds for tax credits are missing. One specific example is approximately $60 million in tax refund claims found hidden in boxes in late 2008 and paid in late 2008 and early 2009. An examination of Chaparral Energy's SEC filings reveals Chaparral reported receiving more than $27 million in tax refunds during this period. Chaparral Energy does not appear in Openbooks?

- Tax credits

- Missing tax credits include - Small Business Venture and Rural Small Business Venture; used to claim refunds and avoid paying gross production taxes, bank privilege taxes, and insurance premium taxes View. This obviously involves large amounts.

- Holding back reporting - What some mistakenly assumed is due to tax filing extensions. The information required is independent of and not found on returns. Rather the information is reported on separate forms in the same fashion and time frame as employer's W-2 forms, 1099s, etc. and required by January 31, following the year investments were made; to allow those filing returns to have the needed information.

The purpose of economic development programs using tax incentives is to encourage investments. The reporting requirements are related to who received incentives for investing and not how or who used tax credits, which are not always the same.

- Missing tax credits include - Small Business Venture and Rural Small Business Venture; used to claim refunds and avoid paying gross production taxes, bank privilege taxes, and insurance premium taxes View. This obviously involves large amounts.

Both substituting incorrect information, and holding back reporting, prevents the public from seeing how the money was used, who received the money and when the money was handed out. Case in point all information need to report 2007 tax credits on Openbooks was filed with OTC by January 31, 2008. Of the total now found on Openbooks - 10% appeared in Jan 2009, 42% October 2009, and 48% not until just recently. We know that does not include tax credits used for refunds - gross production, bank privilege, and insurance premiums View.

It didn't stop there; key features like providing totals were disabled in the tax credit section of Openbooks. Forcing any interested in knowing the totals to visit manually, and calculated 25 line items on 668 pages, to derive totals.

Requirements are to report information on investments and tax credits taken by investors for the year the investments were made. Reporting requirements are the equivalent of an employer's W-2 and 1099's; and reported to the Tax Commission using separate forms, to reported by January 31, and posted on Openbooks by November 1, the year after investments were made. Note: there is a second form required by April 30 that includes additional information.

Instead of reporting the above as required, tax credits are reported as used, user, amount, and year, which is significantly different and prevents the public from learning who received how much, for which investments.

Factoring in the incorrect information is being reported; the following table demonstrates how tax credit usage reporting was held back for at least two years, as seen with 2007 tax credits. There is no reason to assume all has been reported now. Totals projected are based on extrapolating 2008, using the 2007 model, and 2009 using an average of the 2007 and 2008 models, which results in a more conservative total.

| Year reported | |||||

| Year claimed | 2008 | 2009 | 2010 | Totals reported | Totals projected |

| 2007 | $17,896,633 | $73,563,610 | $85,136,895 | $176,597,138 | $176,597,138 |

| 2008 | - | $10,517,290 | $250,065,772 | $260,583,062 | $500,319,479 |

| 2009 | - | - | $13,641,283 | $13,641,283 | $129,592,188 |

| Totals reported by year | $17,896,633 | $84,080,900 | $348,843,950 | $450,821,483 | $629,597,677 |

References:

(1) excluding refunds issued for overpayment of taxes.

(2) Small Business Capital Formation Incentive Act 2357.60 thru 2357.65 and Rural Venture Capital Formation Incentive Act 2357.71 thru 2357.76; and Venture Capital 2357.7