Like the 3,200 other pages of evidence uncovered and descriptions of crimes on this site, this web page is only one part of a massive multi-state entanglement of government corruption and cover-up. See size

Evidence was uncovered in parts over years, and not in the same order as the crimes occurred or the evidence was created. Statements were made based on what was known at the time.

Dates are approximate because government filings and reports vary in some cases up to months if not This is part of cover up. One example is Oklahoma's Openbooks, which started out late with only a fraction of what was required to be added each year. Plus, the data was littered with data entry and spelling errors, meaning you have to go through one entry at a time. This amount to more than 17,000 entries in 2017.

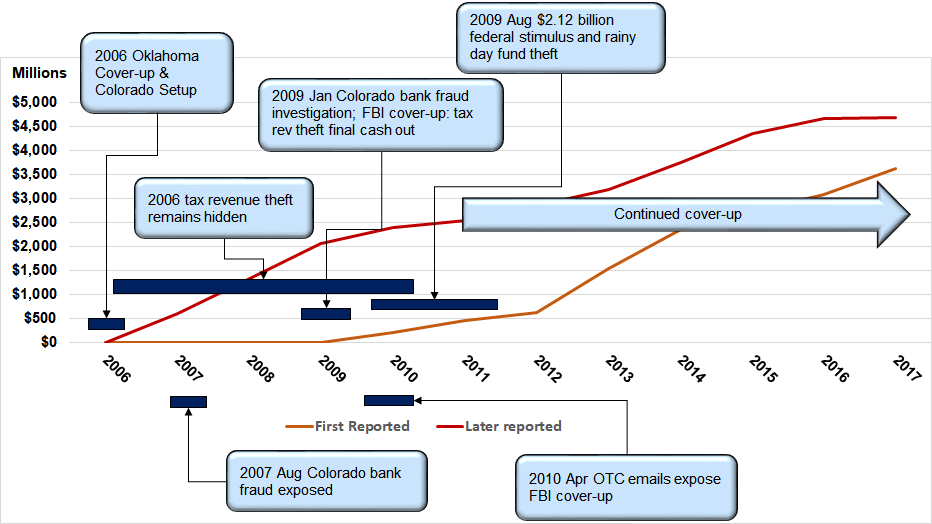

False and Delayed Tax Reporting. 2006 - 2017

No tax credits or tax refunds were ever reported as required by law prior to the 2009 Cover-up! After the 2009 cover-up, some, but not all, were reported. Those reported were falsely reported.

This graph is for fifteen (15) of Oklahoma's sixty-three (63) tax credits types, and three (3) gross production tax refunds types, swapped for four (4) Capital Formation Incentive Act (CFIA) tax credit types. To this date, the three (3) gross production tax refunds and four (4) Capital Formation Incentive Act (CFIA) tax credit types remain unreported!

There are other false reporting issues, including but not limited to View

- $2.12 billion. Oklahoma Authorities Stole Federal Stimulus & Draining Rainy Day to cover-up. View

- Quartz Mountain Aerospace (QMA) Altus OK, like Altus Venture, are subsidiaries of First State Bank Altus OK.

- Oklahoma Tax Commission (OTC).

- Gross Production (GP) Tax Refunds.