Like the 3,200 other pages of evidence uncovered and descriptions of crimes on this site, this web page is only one part of a massive multi-state entanglement of government corruption and cover-up. See size

Evidence was uncovered in parts over years, and not in the same order as the crimes occurred or the evidence was created. Statements were made based on what was known at the time.

Dates are approximate because government filings and reports vary in some cases up to months if not This is part of cover up. One example is Oklahoma's Openbooks, which started out late with only a fraction of what was required to be added each year. Plus, the data was littered with data entry and spelling errors, meaning you have to go through one entry at a time. This amount to more than 17,000 entries in 2017.

For more connections. View

For more timelines. View

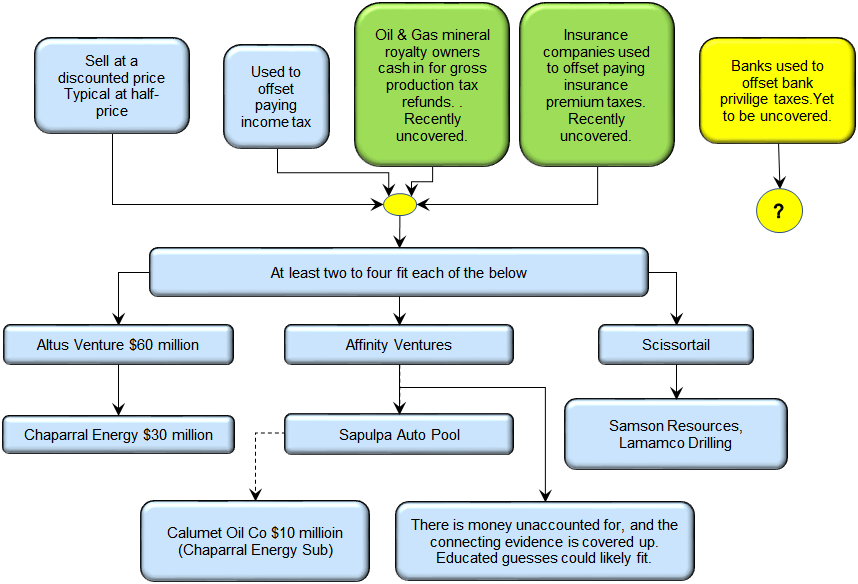

Ways to Monetize (Launder) Tax Credits

- Used to evade paying state income taxes.

- Transfering/Selling.

- Swap tax credits for gross production tax refunds. See 2009 cover-up View

- Used to evade paying Insurance Premium Tax. Oklahoma Statutes §36-624. Report of premiums, fees and taxes. View

- Used to evade paying bank Privilege taxes. Oklahoma Statutes §68-2370. View Still covered-up and suspected of being the largest.

Re: Oklahoma Tax Credit Types View