Like the 3,200 other pages of evidence uncovered and descriptions of crimes on this site, this web page is only one part of a massive multi-state entanglement of government corruption and cover-up. See size

Evidence was uncovered in parts over years, and not in the same order as the crimes occurred or the evidence was created. Statements were made based on what was known at the time.

Dates are approximate because government filings and reports vary in some cases up to months if not This is part of cover up. One example is Oklahoma's Openbooks, which started out late with only a fraction of what was required to be added each year. Plus, the data was littered with data entry and spelling errors, meaning you have to go through one entry at a time. This amount to more than 17,000 entries in 2017.

Paul Doughty's testimony regarding criminal profits, 06/30/2016, View

Ethanol Products Group LLC (EPG), another Altus OK bank subsidiary's bogus tax credit claim, shows yet another way bogus tax credits are laundered (monetized) to disguise as bonuses paid to coconspirators who were allowed to keep.

One tax credit case not charged as a crime, while a related crime that left the FDIC holding the bag was charged. FDIC and DOJ ignored Ethanol Products Group, a $2 million fraudulent investment claim was one of nine of Affinity Ventures 2006 counterfeit tax credit claims totaling $72 million.

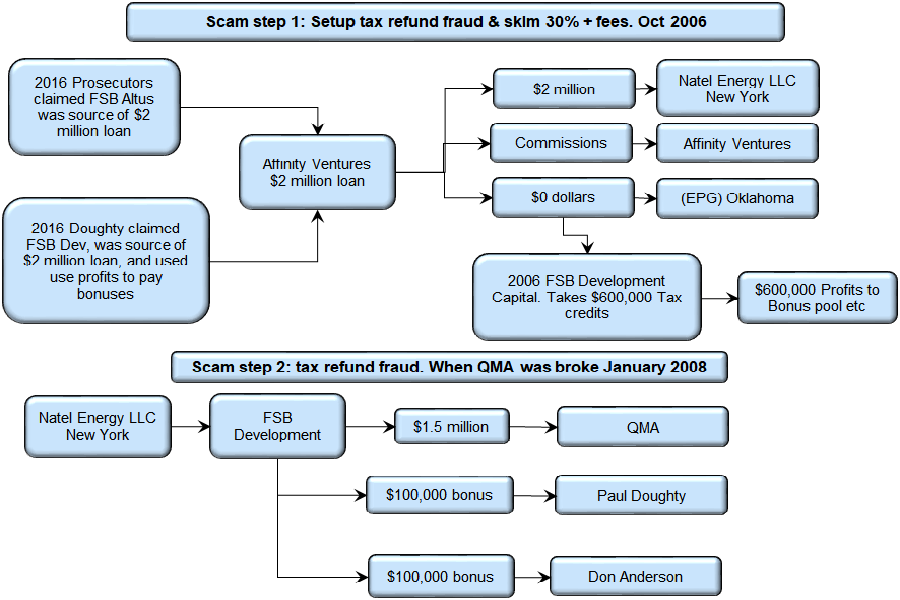

Summary: Case example of multiple scams. One $2 million fake loan.

- October 2006, among other false investment claims, Doughty and Anderson created $600,000 counterfeit 2006 tax credits by claiming the $2 million was invested in EPG in 2006. 2009 OTC swapped the $600,000 counterfeit 2006 tax credits $600,000 gross production tax refunds.

- Instead of investing in 2006, the fake $600,000 was moved from the Altus OK bank and deposited at Nateel (2) a Wall Street firm.

- Jan 2008 Quartz Mountain Aerospace (QMA) ($221 million claimed 2006 investment) was broke, and the $2 million was withdrawn from Nateel and brought back to the Altus bank. Doughty and Anderson charged $100,000 handling fees.

- 2009 the Oklahoma Tax Commission (OTC) swapped Affinity Ventures $600,000 counterfeit 2006 tax credits $600,000 gross production tax refunds.

More background.

Ethanol Products Group LLC (EPG), formed in October 2006 in Oklahoma, is 50% owned by GMI (controlled by Fred Don Anderson) and KSS Investment Consulting LLC (controlled by Paul Harold Doughty), and 50% owned by South Dakota Ethanol Projects Group LLC (SDEPG), and managed by Fred Don Anderson. Ethanol Products Group LLC (EPG) is listed as a subsidiary of First State Bank Altus OK bank holding company.

(1) October 2006 was the deadline for investing money for 2006 tax credit claims that had been previously approved.

2006 Affinity Ventures Capital Company, LLC, claimed FSB Development Capital, LLC, invested $2 million in Affinity Ventures Capital Company, LLC, who claimed to have invested in Ethanol Products Group and took $600K tax credits. $600K went to a profit-sharing and bonus pool.

Jan 2008 Doughty & Anderson withdrew the $2 million deposit from Nateel Energy (3), charged the bank another $100,000 handling fee that went to the profit sharing and bonus pool.

Bonus pool was shared by Doughty, Anderson and other coconspirators, some used by the DOJ as witnessed the cover-up trial. All were allowed to keep their bonuses.

| Notes | Date | Issue | Link |

| 1 | 06/29/2016 | EPG Scam Count 1 Supplemental Trial Brief. DOJ ignored the $2 million 2006 EPG tax credit claim. | View |

| 06/01/2016 | Ethanol Products Group loan. FSB Altus $2 million bank loan for FSB Development Capital, LLC. 5:15-cr-00085 federal criminal trial case files, Pg 5 | View | |

| 06/29/2016 | Supplemental Trial Brief for the United States for Paul Harold Doughty and Fred Don Anderson. 5:15-cr-00085 83 Gov Supplemental Trial Brief, Count 13, Pg. 17 | View | |

| 2 | 1/1/2008 | EPG/Nateel recycled 2006 scam to pay themselves bonus. | View |

| 3 | 1/2/2008 | FSB's EPG/Nateel $ million triple scams. Ethanol Products Group, Affinity Ventures $2 million fraudulent 2006 investment claim ($600K tax credits + fees not charged as crimes) was stashed on deposit at Nateel New York, and in early 2008(2) brought back to loan to QMA while D&A skimmed another $500K fee off the top and the crime charged. | View |

| 02/02/2017 | More EPG/Nateel evidence not filed until seven months after the trial. | View |